Financial sector in Pudong soars in H1

Pudong New Area in East China's Shanghai has maintained steady growth in its financial sector in the first half of this year.

According to official data, the added value of Pudong's financial industry was 244.34 billion yuan ($35.95 billion) during the January to June period, a year-on-year increase of 6.2 percent, accounting for 34.5 percent of the area's first-half GDP, which has provided positive support for Pudong's economic recovery.

After the outbreak of the COVID-19 pandemic in Shanghai earlier this year, Pudong has rolled out a series of supportive policies and measures to boost the recovery of its financial sector, and all of which have played an important role in fully assisting enterprises to recover from the challenges posed by COVID-19 and help strengthen financial assistance for enterprises hit hard by the pandemic.

In July 2021, the Communist Party of China Central Committee and the State Council issued a guideline to support high-level reform and opening-up of Pudong, noting that Pudong should grow into a leading area for socialist modernization and serve as a strategic link between the domestic and international markets.

In the past year, Pudong has continued to improve the financial institution system, and further promote the agglomeration of financial institutions.

Official data shows that as of the end of June this year, Pudong was home to 1,154 licensed financial institutions, including a number of wholly foreign-owned public funds such as BlackRock, the world's largest asset manager, Fidelity International, Neuberger Berman, and JPMorgan, which settled in Pudong in 2020, and is the country's first newly established securities firm with a foreign majority ownership.

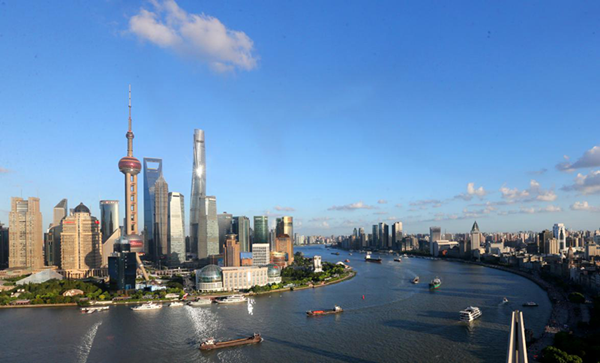

Pudong New Area in East China's Shanghai maintains steady growth in its financial sector in the first half of this year. [Photo by Xu Wanglin for english.pudong.gov.cn]

Contact Us

Contact Us

Brilliant light show to illuminate Huangpu River

Brilliant light show to illuminate Huangpu River Maple leaves paint splendid scenery in Pudong

Maple leaves paint splendid scenery in Pudong Appreciate alluring lotus blossoms in Pudong's Century Park

Appreciate alluring lotus blossoms in Pudong's Century Park New pedestrian street boosts Pudong's night economy

New pedestrian street boosts Pudong's night economy