Why Pudong

Major Progress in China (Shanghai) Pilot Free Trade Zone (SHFTZ)

Investment management innovation has attracted many projects.

In 2015, 18,000 companies set up in the SHFTZ, an annual increase of 20 percent compared with the same period in 2014.

There are 2,039 foreign-invested projects, representing a paid-in foreign investment of $4.59 billion and accounting for over 80 percent of the total foreign investments in Pudong. Investments from Hong Kong increased by 294.9 percent, and investments from the UK, Cayman Islands, South Korea, Samoa and Italy also grew by more than 200 percent.

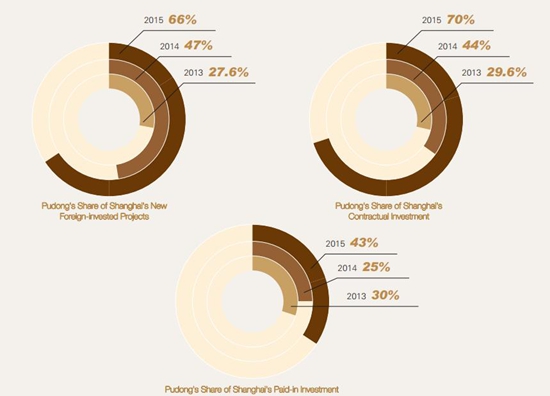

With the establishment and rapid development of the SHFTZ, Pudong has produced a larger share of Shanghai's new foreign-invested projects, and contractual and paid-in foreign investment between 2013 and 2015.

Foreign investment branches out into new areas.

By the end of 2015, nearly 1,200 new projects settled in SHFTZ. National pioneering projects, such as Jiang Tai Reinsurance Brokers Limited and the Anchor Center for R&D and Certification, were launched in the zone.

A boom of outbound investment

In 2015, SHFTZ attracted 636 outbound investment projects, which had a combined Chinese investment of $22.9 billion, 5.5 times as large as that of 2014, accounting for 7% of China's outbound investments.

Trade facilitation has benefited a large number of companies.

The SHFTZ issued nearly 100 facilitation measures, including the fast customs clearance of sea-borne cargo if samples are delivered by air and inspected by customs in advance. All qualified logistics companies inside the bonded zone can store their goods in the same warehouse.

Financial opening-up combined with expanded functions.

Free trade accounts have been able to be used for overseas financing and foreign exchange services since 2015. At the end of 2015, a total of 44,000 free trade accounts were registered with an accumulated receipt and payments of more than 2 trillion yuan ($297.07 million), of which more than 1 trillion yuan were used in the settlements of cross-border trade.

Thanks to financial reforms in the SHFTZ, the transaction volume of Shanghai's financial markets reached 1,463 trillion yuan in 2015, which was 3.5 times higher than in 2010. The added value of the financial sector grew by 22.9 percent in a year, contributing to 16 percent of Shanghai's and 26 percent of Pudong's GDP.

Contact Us

Contact Us

Brilliant light show to illuminate Huangpu River

Brilliant light show to illuminate Huangpu River Maple leaves paint splendid scenery in Pudong

Maple leaves paint splendid scenery in Pudong Appreciate alluring lotus blossoms in Pudong's Century Park

Appreciate alluring lotus blossoms in Pudong's Century Park New pedestrian street boosts Pudong's night economy

New pedestrian street boosts Pudong's night economy